Fear of Missing Out with Varta

| # | Name | Performance 7 days | bought in this wikifolio, among others |

| 1 | 7,32% | EuropeanQualityChampions | |

| 2 | 8,16% | turn around global | |

| 3 | 12,83% | Growth trend invest Long | |

| 4 | 7,81% | Top 100 Community Aktien | |

| 5 | 10,64% | High Growth Stocks |

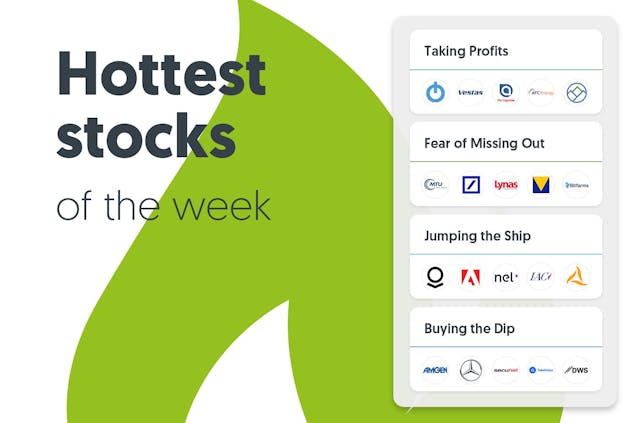

share price performance had been a bitter disappointment for a long time. Since the beginning of 2021, the share price had plummeted from over € 180 to under € 14. The battery manufacturer was once seen as the great German hope with regard to the growth in the electric vehicle market. Last year, however, the company had to put the construction of a factory for electric vehicle battery cells on hold due to cost issues. However, the construction plans for Ellwangen, Baden-Württemberg, have probably not yet been completely put to bed. Perhaps this is one of the reasons why the share price has recently been able to recover from its summer lows, peaking at over € 20. In recent days, the share price has probably risen due to rumors of a major order from Apple. This also motivated some wikifolio traders to enter the market, as the current trading sentiment for Varta shows:

Trading-Sentiment:

However, experienced financial journalist Christian Scheid (Scheid) advises investors to be cautious despite this speculation fuelled by the Varta Management Board itself. In his opinion, a capital increase at the ailing company is "only a matter of time". For this reason, the wikifolio trader does not currently hold stock in any of his trading ideas.

Buying the Dip with Mercedes-Benz

| # | Name | Performance 7 days | bought in this wikifolio, among others |

| 1 | -5,64% | Relative Stärke Dow-Nasdaq-Werte | |

| 2 | -9,08% | TITAN-HERO | |

| 3 | -25,57% | Relax Trading | |

| 4 | -5,03% | Value and Special Opportunities | |

| 5 | -7,50% | JM konservativ |

Car manufacturers' results are not going down well on the market at the moment. Rising costs, persistent bottlenecks in the supply chain, the weakening economy and an increasing price war for electric vehicles are giving companies a hard time. Although the latest figures for were slightly higher than expected, the cautious outlook still caused the share price to fall sharply week-on-week. In terms of profit margin, the Stuttgart-based company will probably only land in the lower half of its target range. Although CFO Harald Wilhelm spoke at the analysts' conference of "incoming orders going in the right direction" and does not expect car sales to fall in 2024 at least, some banks have lowered their share price targets as a precaution.

Many wikifolio traders have therefore taken the price losses as an opportunity to invest in this stock. A look at the trading sentiment shows a clear buyer sentiment at Mercedes-Benz in the last few days, reflecting the tendency of recent weeks and months:

Trading-Sentiment:

Taking Profit with Orsted

| # | Name | Performance 7 days | sold in this wikifolio, among others |

| 1 | 5,51% | Goldesel-Investing | |

| 2 | 6,25% | Mawero Kapitalaufbau1 | |

| 3 | 5,35% | Dual Momentum Global Offensiv | |

| 4 | 5,57% | Ethisch-ökologischer Mix | |

| 5 | 7,80% | Isa Investment |

The trend towards the increased use of renewable energies is unmistakable. Nevertheless, many of the companies operating in this sector are currently experiencing huge issues. , for example, has been suffering for some time, as a result of losing its Spanish wind power subsidiary Siemens Gamesa. Share price performance in this sector is therefore clearly on a downwards trend. This also applies to the Danish company , the global market leader in offshore wind energy. Year-on-year, their stock has lost 45 % of its value. In the past week, however, the share price has now risen by 5.5 %. One reason for this could be that approval procedures for the construction of new wind farms are to be made simpler and faster in the EU. The background to these plans is that the ratio of wind power in the energy mix must more than double by 2030 if the EU wants to achieve its sustainability targets. At wikifolio.com, however, most investors have probably lost faith in a positive development for Orsted’s share price. As a result, the majority of investors used the bounce-back in share price last week to sell existing positions.

Jumping the Ship with Kinsale Capital Group

| # | Name | Performance 7 days | sold in this wikifolio, among others |

| 1 | -5,68% | Technology and Pharmaceuticals | |

| 2 | -5,58% | Quality and Growth Favoriten | |

| 3 | -6,05% | Champions-Aktien | |

| 4 | -7,66% | Global Top Picks | |

| 5 | -18,28% | Copytrading |

The property and accident insurance company once again presented strong quarterly figures at the end of last week. The company also exceeded analysts' predictions. Despite this, its share price, which had previously been performing very well for significant length of time, lost double-digit value on Friday. The probable reason for this is that the company is showing signs of slowing growth. Due to this development, some wikifolio traders have most likely chosen to play it safe and have sold their stock.

Let’s take as an example Andreas Sauer (Roadrunner), who previously held the Kinsale Capital Group in his wikifolio absolute value. The business economist, who has been active on the stock market since 1996, generally prefers "undervalued shares in companies with a solid business base". In this wikifolio, he focuses primarily on quality stocks, which he believes "can achieve significantly better returns than the market average in the long term". This strategy worked for the Kinsale Capital Group for a long time. However, due to the current price slide, a stop-limit sale was activated, which at least achieved a profit of 3.3 % in the end.

Chart

Disclaimer: Every investment in securities and other forms of investment is subject to various risks. Explicit reference is made to the risk factors in the prospectus documents of Lang & Schwarz Aktiengesellschaft (Final Terms, Base Prospectus together with supplements and the Simplified Prospectuses, respectively) at wikifolio.com , ls-tc.de and ls-d.ch. You should read the prospectus before making any investment decision in order to fully understand the potential risks and rewards of the decision to invest in the securities. The approval of the prospectus by the competent authority should not be construed as an endorsement of the securities offered or admitted to trading on a regulated market. The performance of the wikifolios as well as the respective wikifolio certificates refers to past performance. Future performance cannot be inferred from this. The content of this site does not constitute investment advice or a solicitation to buy or sell securities. This applies in particular to countries in which such an offer to buy or sell is not permitted. For further information, please refer to our General Terms and Conditions.