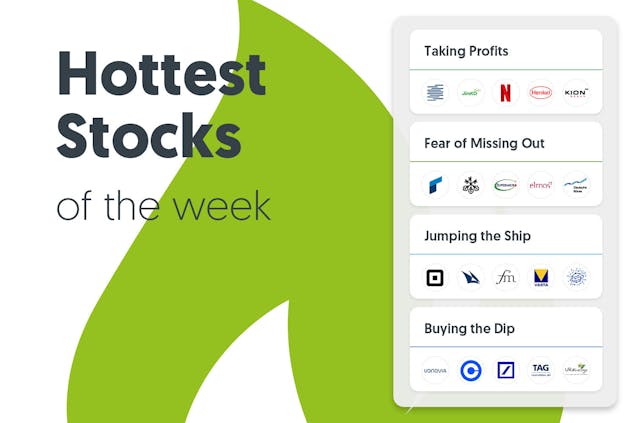

Fear of Missing Out at Dax newcomer Rheinmetall

| # | Name | Performance | bought in this wikifolio, among others |

| 1 | 10.41% | ForInc TrendInvest | |

| 2 | 5.88% | Nachhaltige Dividendenstars | |

| 3 | 17.38% | Nordstern | |

| 4 | 8.78% | Nebenwerte Europa | |

| 5 | 5.88% | Intelligent Matrix Trend |

Last week, wikifolio traders bought defence company stocks, as prices were rising. Strong results, together with the company's rise in the Dax rankings are responsible for this recent performance. Richard Dobetsberger (Ritschy) knows more:

The German technology group Rheinmetall has continued its profitable growth course and once again closed the 2022 financial year with record figures. The group generated sales of EUR 6,410 million, up 13% on the previous year.

Week-on-week, the share price is up by 10.41 %. Since the start of the Russian military campaign against Ukraine, the value of Rheinmetall stock has increased from just under EUR 100 to currently over EUR 260. In Dobetsberger's wikifolio Umbrella, the Rheinmetall share is by far the largest position with a weighting of over 30 %.

Chart

Buying the Dip at Immo-Shares

| # | Name | Performance | bought in this wikifolio, among others |

| 1 | -9.82% | Aktien-Werte First | |

| 2 | -11.34% | World's Best Brands | |

| 3 | -6.61% | Nordstern | |

| 4 | -7.78% | 25 Jahre Börsenerfahrung | |

| 5 | -7.68% | Hard'n'Heavy - Krisensichere Investments |

Rising interest rates are having a negative impact on real estate shares. (-9.82 %) and (-7.78 %), for example, are both down week-on-week. Both companies have recently presented figures, in which they reported a significant drop in consolidated earnings. wikifolio traders are not unsettled by this and are buying the dip. Many seem to believe that the sector is over the worst. Among them is Stefan Heinzmann (einmaleins). He comments:

The ECB won’t raise interest rates again so quickly. The first banks are already getting into difficulties. The economy will be facing problems soon too. Property prices in the big cities are still stable at the moment though.

In Heinzmann's wikifolio Zinsfuß, Vonovia stock is currently weighted at 7.2 %.

Chart

Taking Profit at Netflix

| # | Name | Performance | sold in this wikifolio, among others |

| 1 | 5.16% | Trendstarke Deutsche Aktien 2 | |

| 2 | 10.67% | Tech & GreenTech Aktienwerte | |

| 3 | 8.67% | KI-Investor | |

| 4 | 6.03% | Deutsche Aktien Top50 | |

| 5 | 12.74% | RS Handelssystem |

new low subscription model is gaining momentum. Two months after its launch in the U.S., their subscription model, which includes advertising, currently has around 1 million monthly users. Fears that this growth would be primarily fed by existing customers switching to the low-cost subscription model seem to have been unfounded. According to Netflix, users of the new ‘basic subscription’ are largely new or returning customers. This news has been well received on the stock market, with stock up significantly (8.67%) week-on-week. Some wikifolio traders are using the upwind to take profits.

Trading Sentiment

Jumping the Ship: Accusations of fraud at Block

| # | Name | Performance | sold in this wikifolio, among others |

| 1 | -18.00% | Nordstern | |

| 2 | -64.14% | Fiedler Invest Global | |

| 3 | -12.57% | Special Situations | |

| 4 | -20.94% | eMobility | |

| 5 | -15.02% | NEO BOOM Ridin Digital Bulls AB |

Last week, fraud allegations against the mobile payment provider (formerly known as Square) caused shockwaves. wikifolio Trader Christian Scheid (Scheid) can explain the background to this:

The company is accused of manipulating the number of its cash app users – by between 40 and 70 %! In addition to this, according to Hindenburg research, the company also did nothing to combat the illegal use of its app by criminals. Block allegedly failed to comply with financial regulations and anti-money-laundering laws when monitoring its customers.

In his wikifolio Special Situations long/short, Scheid reacted to the news last week by buying turbo short certificates. The sale of the derivatives in several tranches in the meantime brought the experienced wikifolio trader between 5 and 12 % return.

Chart

Disclaimer: Every investment in securities and other forms of investment is subject to various risks. Explicit reference is made to the risk factors in the prospectus documents of Lang & Schwarz Aktiengesellschaft (Final Terms, Base Prospectus together with supplements and the Simplified Prospectuses, respectively) at wikifolio.com , ls-tc.de and ls-d.ch. You should read the prospectus before making any investment decision in order to fully understand the potential risks and rewards of the decision to invest in the securities. The approval of the prospectus by the competent authority should not be construed as an endorsement of the securities offered or admitted to trading on a regulated market. The performance of the wikifolios as well as the respective wikifolio certificates refers to past performance. Future performance cannot be inferred from this. The content of this site does not constitute investment advice or a solicitation to buy or sell securities. This applies in particular to countries in which such an offer to buy or sell is not permitted. For further information, please refer to our General Terms and Conditions.